mississippi state income tax 2021

The Mississippi income tax rate for tax year 2021 is progressive from a low of 0 to a high of 5. Ad e-File Federal to the IRS for Free and Directly to Mississippi for only 1499.

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Single filers can claim a deduction of 2300 while married taxpayers can receive 4600.

/dotdash-INV-final-How-the-Ideal-Tax-Rate-Is-Determined-The-Laffer-Curve-2021-01-9873ad4f5a464341aa6731540b763d76.jpg)

. Whats new in 2021 for Mississippi. The default exemption based on marital status has changed to zero 0 if the employee has not filed. IndividualFiduciary Income Tax Voucher REPLACES THE 80-300 80-180 80-107.

2021 Legislative Session Senate kills Mississippi income tax elimination. TaxFormFinder provides printable PDF copies of 37 current Mississippi income tax forms. Mississippi Income Tax Calculator 2021 If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472.

31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due date. Mississippi has a state income tax that ranges between 3 and 5 which is administered by the Mississippi Department of Revenue. Find your gross income.

Individual Income Tax Notices. A downloadable PDF list of all available Individual Income Tax Forms. The state income tax table can be found inside the Mississippi Form 80-105 instructions booklet.

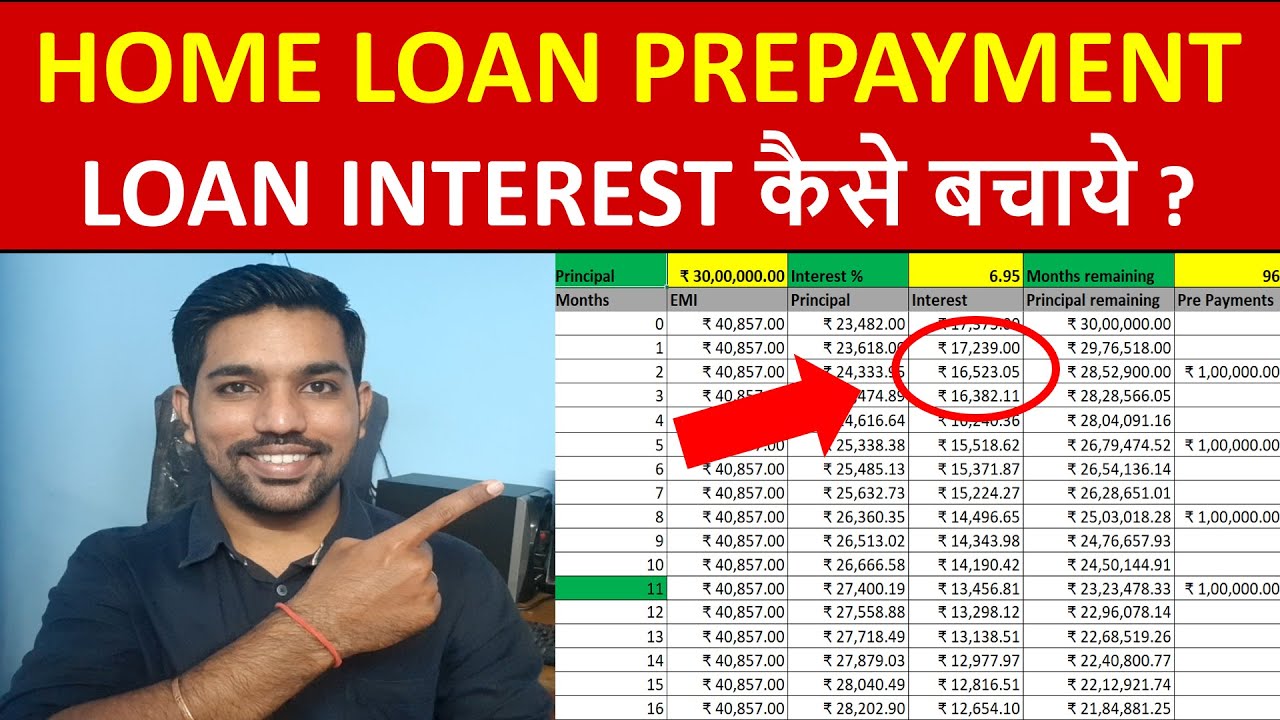

The current tax year is 2021 and most states will release updated tax forms between January and April of 2022. Tax rate of 4 on taxable income between 5001 and 10000. Use this instructional booklet to aid you with filling out and filing your Form 80-105 tax return.

80-315 Re-forestation Tax Credit. Mississippi Code at Lexis Publishing Income Tax Laws Title 27 Chapter 7. Ad Read Customer Reviews Find Best Sellers.

Tax Rate Income Range Taxes Due 0 0 - 4000 0 within Bracket 3 4001 - 5000 3 within Bracket 4 5001 - 10000 4 within Bracket. Find your income exemptions. Check the 2021 Mississippi state tax rate and the rules to calculate state income tax.

80-205 Non-Resident and Part-Year Resident Return. Ad The Leading Online Publisher of National and State-specific Legal Documents. For the Single Married Filing Jointly Married Filing Separately and Head of Household filing statuses the MS tax rates and the number of tax brackets.

2021 Form 80-100-21-1-1-000 Rev821 RESIDENT NON-RESIDENT AND PART-YEAR RESIDENT INCOME TAX INSTRUCTIONS INDIVIDUAL INCOME TAX BUREAU PO BOX 1033 JACKSON MS 39215-1033 WWWDORMSGOV 2021 2 TABLE OF CONTENTS WHATS NEW. 80-115 Declaration for E-File. You may file your Form 80-105 with paper.

The 2021 Mississippi State Income Tax Return forms for Tax Year 2021 Jan. Form 80-105 is the general individual income tax form for Mississippi residents. 601 923-7094 Electronic Filing 2021 Approved Providers for E-File 2020 Approved Providers for E-File 2019 Approved Providers for E-File 2018 Approved Providers for E-File 2017 Approved Providers for E-File Electronic Filing E-File Online Access Corporate Franchise and Pass-through Entities may register for online access in TAP.

If you are receiving a refund PO. E-File Directly to the IRS State. Pay Period 05 2021.

Tax Year 2021 First 4000 0 and the next 1000 3 Tax Year 2022 First 5000 0. Only expenditures incurred after January 1 2021 qualify for owner-occupied residential credits. Form 80-100 - Individual Income Tax Instructions.

3 LEGISLATIVE CHANGES 3 REMINDERS 3 FILING REQUIREMENTS 4 DO I HAVE TO FILE. The income tax withholding formula for the State of Mississippi includes the following changes. House tries to revive it by Geoff Pender March 16 2021 2021 Legislative Session Mississippi tax overhaul on life support as deadline looms by Geoff Pender March 15 2021 2021 Legislative Session Reagan economist Laffer endorses Speaker Gunns tax proposal.

Mississippi taxes income at rates of 0 percent 3 percent 4 percent and 5 percent as of 2021. Because the income threshold for the top bracket is quite low 10000 most taxpayers will pay the top rate for the majority of their income. Free 2-Day Shipping wAmazon Prime.

71-661 Installment Agreement. Tax rate of 5 on taxable income over 10000. Mississippi Tax Brackets for Tax Year 2021 As you can see your income in Mississippi is taxed at different rates within the given tax brackets.

The Mississippi Form 80-105 instructions and the most commonly filed individual income tax forms are listed below on this page. Rehabilitations qualifying for the federal historic preservation tax credit will also qualify for the state tax credit. Residents can take advantage of the deductions and exemptions the state offers.

Find your pretax deductions including 401K flexible account contributions. How to Calculate 2021 Mississippi State Income Tax by Using State Income Tax Table. 80-155 Net Operating Loss Schedule.

All other income tax returns P. 80-160 Credit for Tax Paid Another State. The tax brackets are the same for all filing statuses.

The thresholds break down like this. Department of Revenue - State Tax Forms. Any income over 10000 would be taxes at the highest rate of 5.

4 AM I A RESIDENT. Free 2021 Federal Tax Return. Box 23058 Jackson MS 39225-3058.

What Are the Tax Rates in Mississippi. Hurricane Katrina Information Resources. You must file online or through the mail yearly by April 17.

You must file online or through the mail yearly by April 17. If you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing penalty. 11-0001 Form 80-106 - Payment Voucher You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding.

0 percent on income up to 3000 3 percent of income from 3001 to 5000 4 percent of income from 5001 to 10000 5 percent of income over 10000. Property owners who are applying for both the federal and state tax credits need only submit the federal tax. Instantly Find Download Legal Forms Drafted by Attorneys for Your State.

The standard deduction for No W-4 filed has changed from 4600 to 2300. Box 23050 Jackson MS 39225-3050. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5.

The income tax table has changed. Form 80-105 is the general individual income tax form for Mississippi residents. House Bill 1356 - To provide that for the state income tax deduction authorized for depreciation in the case of new or used aircraft equipment engines.

States With Highest And Lowest Sales Tax Rates

States With No Income Tax H R Block

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

Alabama Tax Rates Rankings Alabama Taxes Tax Foundation

Lowest Highest Taxed States H R Block Blog

State Income Tax Rates Highest Lowest 2021 Changes

Excel Formula Income Tax Bracket Calculation Exceljet

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

/dotdash-INV-final-How-the-Ideal-Tax-Rate-Is-Determined-The-Laffer-Curve-2021-01-9873ad4f5a464341aa6731540b763d76.jpg)

How The Ideal Tax Rate Is Determined The Laffer Curve

Mississippi State Taxes 2021 Income And Sales Tax Rates Bankrate

Irs Form 1099 Nec In 2021 Irs Forms Federal Income Tax State Tax

How Do State And Local Individual Income Taxes Work Tax Policy Center

Here S The Average Irs Tax Refund Amount By State

Standard Deduction 2020 2021 What It Is And How It Affects Your Taxes Wsj

When Are Taxes Due In 2022 Forbes Advisor

Mississippi Tax Rate H R Block

The Corporate Tax Component Of Our Index Measures Each State S Principal Tax On Business Activities Most States Lev Business Tax Income Tax Cost Of Goods Sold

State Corporate Income Tax Rates And Brackets Tax Foundation